Hollywood production values without the cost.

Minimum risk.

Maximum return.

Scroll to register for full access to GlobalWatch.com

Welcome to GlobalWatch Films, a British film production company established in 2013. We aim to develop and produce a slate of ambitious and thrilling mainstream film projects designed to captivate both UK and international audiences while maximising on commercial appeal. Presently, we are actively engaged in the production of 12 spectacular movies, featuring a lineup of esteemed directors, actors, and an award-winning creative crew.

We utilise various tax schemes both in the UK and internationally to minimise and eliminate risk for investors and to maximise profits. Some of the schemes we use include the UK Government’s Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS), soft monies such as lottery funding, sponsorship, advertising, and tax incentives for filming either in the UK or in foreign locations which can be as much as 40% of the film’s budget.

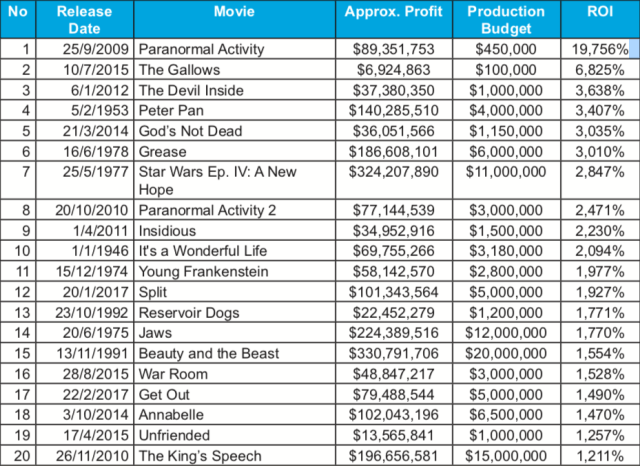

Like most competitive industries well-planned, well-manned, and well-executed projects can make exceptional returns for investors, sometimes exponential, as can be seen in the phenomenal returns in the table to the right.

Most Profitable Films, Based on ROI

GlobalWatch.com contains sensitive information about film projects and partners. To gain access please click below and register for free using your email.